Теперь рассмотрим опционы, с которыми работает наша компания. Рекомендации на покупку или продажу этих финансовых инструментов вы будете получать от нас довольно часто.

ПОКУПАЕМ опционы PUT и CALL

Кода мы осуществляем ПОКУПКУ опциона, мы платим за него. Когда мы осуществляем ПРОДАЖУ опциона – нам платят премию за эту операцию

В этой статье рассматриваем наши операции по ПОКУПКЕ опциона.

Пример рекомендации на приобретение опциона от 13.01.2022.

https://t.me/carefulinvest1/20

Option EURUSD. PUTBUY. Strike 1,1450. Expiration 14.02.22. Cost now- 0,0071 point

Пояснение; В этой рекомендации мы предлагаем нашим клиентам купить ванильный опцион put. Страйк-1,1450. Экспирация 14.02.22. Стоимость сейчас – 0,0071 пункт.

Основание: предполагаем дальнейшее укрепление доллара против евро, как и в отношении других валют. Но рынок еще неоднократно может выбить наши стопы. Если сейчас купим опцион put, заплатив за 100К EURUSD 710 долларов, можно чувствовать себя относительно спокойно. При движении курса с нынешних уровней до 1,1380 -1,1370 уже «при своих». Однако скорей всего возможно движение до 1,12, а то и ниже.

Что такое «страйк»? Это курс валютной пары. В нашем примере – 1,1450.

Что такое «экспирация»? Дата, до которой опцион будет действителен. В нашем примере мы приобретаем опцион сроком на месяц. Дата экспирации – 14.02.22. Но мы можем приобретать опцион на любой срок «от недели».

Когда мы даем рекомендацию на приобретение опциона, мы учитываем множество различных факторов. Отсюда и вычисляется срок, на который мы покупаем этот опцион. Чем больше срок, тем больше стоимость опциона. Например, в рассматриваемом опционе мы платим за месячный опцион 0,0071 пункт в паре EURUSD или 710,00 долларов при сумме опциона 100 тысяч. А стоимость такого же опциона на два месяца нам обошлась бы как минимум 0,0120 пунктов или 1200 долларов.

Что такое «при своих»? Опцион «при своих» на нашем примере. Страйк – 1,1450. Опцион PUT, мы прогнозируем движение валютной пары вниз по графику, то есть укрепление доллара против евро. Мы заплатили за опцион 0,0071 пункт. Когда курс достигнет отметки 1,1379 – мы выйдем в ноль, то есть ничего не потеряем из заплаченных нами 710 долларов за опцион (к нам вернутся деньги, которые мы заплатили за покупку опциона – 710,0 долларов) , и даже немного заработаем (такая система). Все, что ниже курса 1,1379 – уже генерирует нашу прибыль. 1,1375- заработали 40 долларов на 100тыс.опциона, 1,1305 – заработали 740 долларов, и так далее.

Можем ли закрыть(реализовать) (эксперировать – expiration) опцион раньше времени, то есть до истечения срока жизни опциона? Да, и такое происходит с большинством опционов.

По рекомендации на покупку опциона от 13.01.22 (см.выше) наши клиенты закрыли(реализовали) опцион PUT EURUSD 27.01.22 и смогли заработать:

если покупали опцион на 100 к — прибыль составила 1640,00 USD

те, кто покупал на 1,0 мио — прибыль составила 16400,00 USD

https://t.me/carefulinvest1/44

В каких случаях мы даем вам рекомендацию реализовать (expiration) опцион раньше срока его жизни? Кстати, в 95 процентах случаев торговли опционами мы реализовываем их до окончания даты экспирации.

1.Когда мы видим, что уже имеем определенную прибыль, но предполагаем, что дальнейшее движение валютного курса в нашем направлении может быть затруднено или связано с рисками отката курса. Но почему бы не реализовать опцион, если при заплаченных 710 долларов за него(позиция – 100к), мы уже имеем прибыль 420 долларов? Вложили 710$?, забрали обратно 1130$. Неплохо?

2.Когда мы видим, что наши ожидания движения валютного курса не оправдываются, и динамика рынка предполагает или движение в противоположенном направлении или боковой тренд, что нам абсолютно невыгодно и убыточно. В этом случае, мы даем рекомендацию реализовать опцион с потерями. С относительно небольшими потерями. Например, заплатили за опцион 710$, по нашей рекомендации закрыли опцион, когда его стоимость составляла 520$. Да, потеряли на этой сделке 190$, но не 710$, верно?

Главное – вовремя выйти из позиции, из опциона. Не «захлебнуться» от жадности(выйти с прибылью необходимой и достаточной) и не «жить надеждой, которая умирает последней»(выйти с разумным убытком, а не с полным).

Почему же мы торгуем опционами? Казалось бы, есть Forex spot – все ясно и понятно. Продал 100к по курсу 1,1450 и не нужно отсчитывать 71 пункт, пока начнет «капать» прибыль. Можно уже вообще закрыть позицию на рынке безубыточности опциона – 1,1379, получить свои заработанные 710 долларов и идти «курить бамбук».

Все так. Но не будем забывать, что рынок волатилен. И прежде чем он доберется до курса 1,1379 рынок вполне может сходить на 1,1520, что выбьет ваш стоп-лосс с потерей 700,0 долларов, затем опустится на 1,1400, потом еще куда-то, а уж потом начнется более-менее явный тренд вниз на укрепление доллара.

Опцион – наше спокойствие. Никаких стоп-лоссов(хотя отслеживать нужно), Просто ждем. Да, без больших прибылей как на споте, но и БЕЗ БОЛЬШИХ ПОТЕРЬ.

Обычная торговая деятельность, как в товарных операциях. Вложил в товар(опцион) 710 долларов, обернул деньги с прибыльностью. Вложил деньги в товар, что-то пошло не так (поставщик обманул, товар испортился, налоговая «наехала», еще 50 причин) – «вытащил» деньги с некоторым убытком.

Почему же брокеры склоняют трейдеров к осуществлению операций на FX спот, а не на рынке опционов, а трейдеры редко занимаются опционами, предпочитая рискованный FX спот?

Вот почему:

1. Во-первых, большинство брокерских контор позволяют торговать на FX споте торговым счетом от 50,0 USD, предоставляя кредитное плечо 1:200, и как понимаете, жадность и азарт плюс неопытность трейдера, практически сразу «выметают» с его счета будь то 50 долларов, будь то 500 долларов, и затем трейдер отправляется искать новые деньги для пополнения счета и «адреналина». Для того, чтобы торговать опционами (в торговле опционами нет маржинального плеча-кредита) нужно иметь на торговом счете хотя бы 500-700 долларов, чтобы работать с опционом на 100к.

2. 95 процентов брокерских контор не предоставляют своим клиентам возможность торговать опционами, так как клиентские сделки на споте гораздо выгодней для брокерской конторы, чем опционные.

3. 98 процентов трейдеров даже не хотят учится торговле опционами. Сила привычки торговли на споте. Да, действительно, торговля опционами – более сложная штука, чем торговля на споте. Нужно овладеть более существенным объемом знаний. Все эти «Дельта», «Гамма», «Тета», «Вега». Но мы и не отсылаем вас к учебникам или долголетней практике. Все, то от вас требуется для торговли опционами – это прочесть нашу рекомендацию, войти к вашему брокеру, открыть окно торговли опционами, выставить значения согласно нашей рекомендации: «CALL or PUT ( вверх или вниз) «Strike»(страйк), «Date of expiration»(дату экспирации) и самое главное, сделать транзакцию : «BUY or SELL (Продать или Купить)

ЧТО ТАКОЕ PUT. Это движение курса валютной пары на графике, который перед вами вниз. Соответственно, если вверх – CALL. Вот так «мудрено» в опционной торговле. Да, мы можем сравнить с термином торговли на споте – SELL, что тоже – ВНИЗ, но это не совсем правильно, так как мы можем опционы как покупать – BUY, так и продавать – SELL.

Разбираем, что вам нужно будет сделать, когда вы получите от нас рекомендацию КУПИТЬ опцион. Используем для иллюстраций торговый интерфейс одного из известных брокеров.

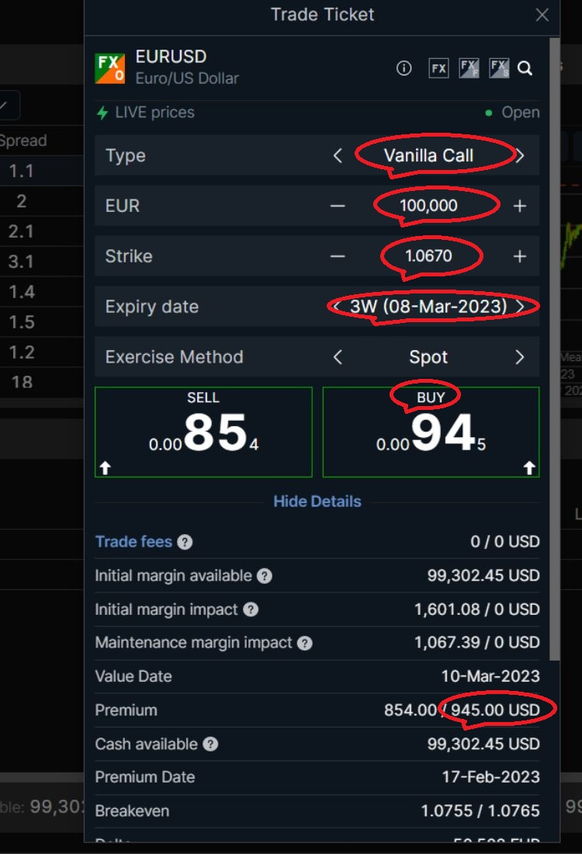

Пример рекомендации по покупке опциона CALL. Поясняю, что рассматриваемые нами опционы называются ВАНИЛЬНЫЙ. В отличии от бинарных, которые мы будем рассматривать в других статьях.

15.02.23

RECOMMENDATION

Option EURUSD. CALLBUY; Strike – 1,0675; Expiration – 08.03.23. Cost now – 0,0094,5

Что вам необходимо сделать.

1. Выставить операцию. Выбрать CALL

2. Выбрать сумму. Например: 100,000

3. Выставить цену – strike: 1,0670

4. Выставить дату Expiry date: 08.03.23. Как правило у всех брокеров мы можем купить или продать опцион на срок от одной недели. Мы по определенным причинам в нашем конкретном примере выбираем три недели от даты покупки опциона: 08.03.23

Смотрим сколько пунктов нам нужно заплатить за опцион и в информации смотрим сколько это будет выражено в деньгах.

За опцион нам нужно будет заплатить 0,0094,5 пункта, что при сумме 100,000 составит 945,00 USD

Жмем кнопку : BUY

Вот и все, что вам нужно будет сделать. Как видите – нажать несколько кнопок. Купив опцион в дальнейшем мы будем руководствоваться стратегиями и тактиками, описанными выше. Ежедневно мы будем фиксировать состояние нашего опциона(так же как вы сможете видеть на своем счете у вашего брокера), а также будем рекомендовать вам дальнейшие действия с этим опционом в зависимости от ситуации, складывающейся на рынке.

ПОДПИСЫВАЙТЕСЬ НА КАНАЛ И ПОЛУЧАЙТЕ РЕКОМЕНДАЦИИ